Here’s how long it takes to save for a house in Arizona

Arizona singles are facing a race against time. Even with an affordable mortgage, they still need anywhere from 19 to 26 years more than couples to save for a house in Arizona.

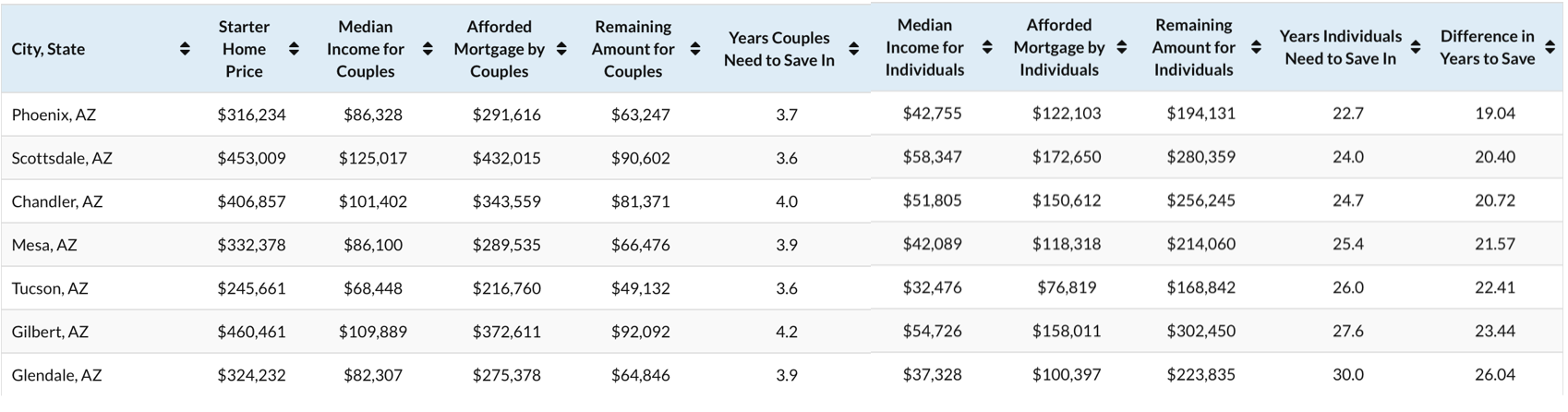

We looked at how much time it would take an individual to save to cover the amount between the loan and the price of a starter home, compared to a couple. Here’s what we found for Arizona’s largest cities:

- Singles aiming for a starter home struggle to bridge the gap between the mortgage they can afford and the home price. To cover this difference, they need to save from almost 23 years in Phoenix to 30 years in Glendale.

- For couples in Arizona, things are much easier. In all the cities analyzed (including Tucson, Scottsdale, Mesa, Chandler, and Gilbert) they need to budget for just around 4 years.

Single people don’t need to be reminded of the perks of having a significant other — especially during the month of love. But, they’d be happy to know that those perks aren’t automatically financial. In a few select cities in the Midwest, saving up to buy that first home can be almost as swift for singles as it is for couples — give or take a few months.

Solo, single, self-partnered… whatever the label, this cohort has had it rough in a housing market defined by sky-high prices, scarce inventory, and the almost-extinct concept of a starter home. With the median starter home price more than doubling in the past 20 years, singles in America’s major cities might take around 6 years more than couples to set money aside for an entry-level home.

Diligently saving up to cover what a bank loan doesn’t is a strenuous financial effort — particularly for those budgeting on their own.

Categories

Recent Posts

GET MORE INFORMATION